How important is idea generation in investing?

As with all things, it depends.

In this article I am going to walk you through a helpful little conceptual framework that estimates how important idea generation is for you and your team based on your goals. I will also show that the charming advice of Warren Buffett and Charlie Munger is not only entertaining but also statistically sound and based on a deep intuition of probability theory.

But first, what is idea generation? Idea generation is one of the three core processes followed by most investment teams. These are:

- Idea generation: all companies ➔ companies analyzed.

- Investment process: companies analyzed ➔ companies selected.

- Risk management: companies selected ➔ managed portfolio.

Most investment teams spend a lot of time trying to improve these steps. A strong belief of mine is that in order to truly improve a process you first need to know exactly what that process is supposed to do. You need to understand the goal. With idea generation, there are two goals:

- Identify good ideas that are more likely to make it through the investment process whilst, simultaneously,

- Filtering out bad ideas that are less likely to make it through the investment process for one or more reasons.

Did you notice my choice of words there? More likely and less likely. The goal of idea generation is to change probabilities. Put differently, the purpose of idea generation is to improve your selection odds.

In other words, idea generation is a statistical problem and, as such, you can use some relatively simple statistical tools to model and improve it.

Let's make this real. Imagine a hypothetical fund called Improbable Capital. They are a traditionally-managed global equity fund. Their goal is to buy and hold wonderful companies from around the world at reasonable prices.

- They employ a team of 8 CFA analysts.

- Each analyst produces a detailed research report on least 1 company per month ahead of their monthly investment committee meeting.

- Improbable Capital can analyze 8x12=96 companies a year.

- Improbable Capital aims to own a diversified portfolio of at at least 60 companies in different geographies and industries.

- Improbable Capital aims to hold companies for at least 3 years.

- In any given year Improbable Capital needs to invest in 60/3=20 companies per year based on their 60 stocks & 3-year mandate.

- Therefore, the % of companies that get picked after their investment committee must equal 20/96=20.1% over time.

- Finally, if you picked any company at random it would have a 2.5% chance of making it through their investment process.

In other words, Improbable Capital's idea generation process needs to improve the their odds of finding a wonderful company at a reasonable price from 2.5% (before) to 20.1% (after).

For the remainder of this article we call the 2.5% the pre-process probability - the probability before idea generation - and the 20.1% the post-process probability - the probability after idea generation. This vernacular has been borrowed from diagnostic testing where doctors refer to the pre-test probability of a disease versus the post-test probability of a disease.

It doesn't actually matter if their idea generation process is a stock screening system, an investment community, sell side reports, the news, or a global equity recommendation system * cough cough *, the goal is the same.

What happens if they can't achieve that goal? Well ...

- Either the analysts maintain their high standards and the number of holdings in their portfolio slowly drops below 60,

- Or the analysts start to bargain with their own process and start picking the "least offensive idea" presented every month.

I hope that neither of these sound familiar to you because no matter how you look at it, an underperforming idea generation process increases risk. Either you own more worse stocks or you own fewer great companies.

So how can they improve? The goal of idea generation is to improve your odds. There are really only three ways to do this and they are:

- Increase the true positive rate (TPR) of your ideas,

- Decrease the false positive rate (FPR) of your ideas, or

- Modify the constraints of your investment process.

Improving TPR and FPR

The true positive rate (TPR) of a process or model is the proportion of positive outcomes that are correctly identified as positive i.e. good ideas that are labelled as good. The false positive rate (FPR) is the proportion of negative outcomes that are incorrectly identified as positive outcomes.

- TPR = good ideas that are actually good ideas.

- FPR = "good ideas" that are secretly bad ideas.

The relationship between the pre-process probability, $P_{\textrm{before}}=2.5\textrm{%}$, and the post-process probability, $P_{\textrm{after}}=20.1\textrm{%}$, is directly linked to the ratio of TPR over FPR. This ratio is called the likelihood ratio, $\textrm{LR} = \frac{\textrm{TPR}}{\textrm{FPR}}$.

The relationship is given by the following probability equation:

$$P_{\textrm{after}} = P_{\textrm{before}} \times \frac{\textrm{LR}}{1 - P_{\textrm{before}} + P_{\textrm{before}} \times \textrm{LR}}$$

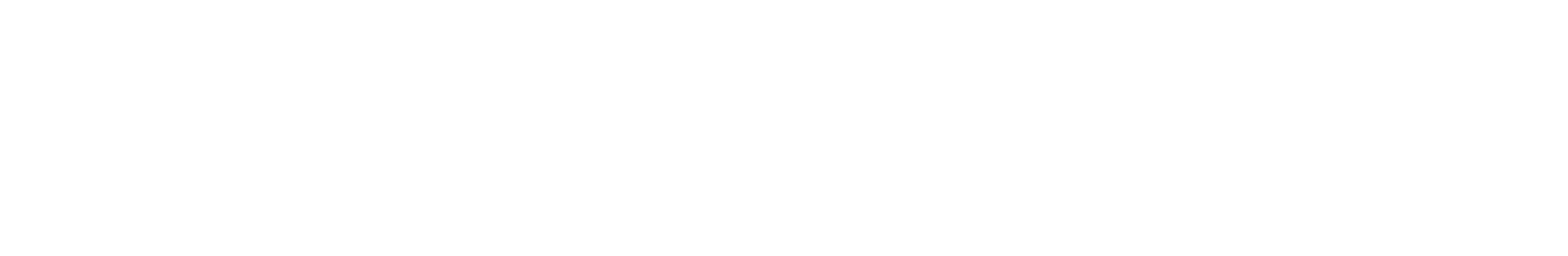

Given this equation the question becomes: what values of TPR & FPR are good enough to boost the probability from 2.5% to 20.1%? Now I know what you're thinking - that's complicated - so in order to make this easy I've created a small Excel spreadsheet that does the calculation for you 😊.

The sheet shows that Improbable Capital should aim to achieve a FPR of less than 10% AND a TPR rate greater than 75% with their process ... which is probably going to be quite difficult since only ~16.33% of the plausible scenarios meet those criteria. So what can Improbable Capital do? They should enroll in the University of Berkshire Hathaway!

The University of Berkshire Hathaway

Here are a couple of things that Improbable Capital can do to reduce the pressure on their idea generation process and increase that ~16.33%**.

1. Manage a more concentrated portfolio

"Munger rued that elite schools teach that the secret of investment management is diversification. They have it backasswards he asserted. Non-diversification is key" - The University of Berkshire Hathaway, Page 172

Intuition: the more good companies you aim to own in your portfolio, the more good ideas you have to come up with every year.

Statistics: moving from 60 stocks to 40 stocks means that instead of needing to boost their odds from 2.5% to 20.1%, Improbable Capital only needs to boost them from 2.5% to 13.89%. The likelihood is now ~25.17%.

WHaT AbOuT dIvERsIfIcATiOn?

Okay SpongeBob, I'm not saying that diversification isn't important - it obviously is - however here are two things you may want to consider.

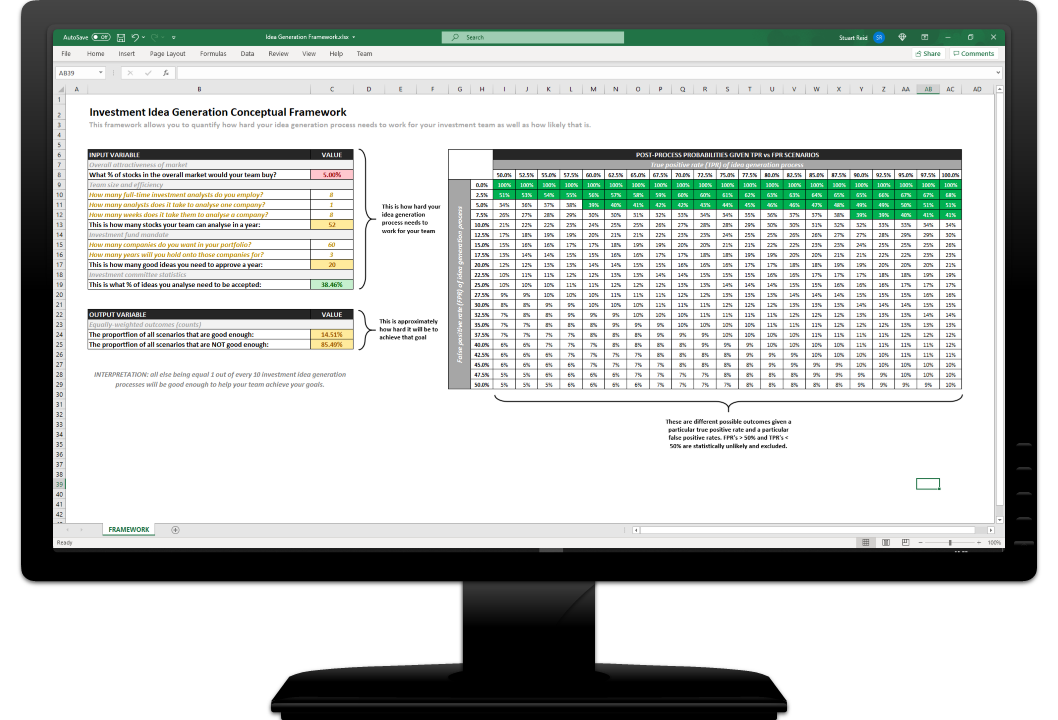

First off, from a statistical standpoint, the benefits of diversification diminish quite quickly. Studies have shown that by the time you own 18 random companies you have already unlocked 90% of the value of diversification. It goes without saying this doesn't work if all 18 are Chinese semiconductor manufacturers so some common sense does need to be applied here.

Secondly, from a practical standpoint, many large businesses are intrinsically diversified. For example, when you buy shares in JP Morgan you are buying into a holding company with more than hundreds of subsidiaries operating in (and generating revenue from) many different countries. So on a look-through basis a selection of 40 stocks could be extremely diversified in terms of business models, geographies, and even sectors and industries.

2. Hold onto companies for longer durations

"An investor should act as though he had a lifetime decision card with just twenty punches on it." - Warren Buffett

Intuition: the more actively you trade in and out of companies, the more good ideas you have to come up with every year.

Statistics: increasing the holding period from 3-years minimum to 7-years minimum means that instead of needing to boost their odds from 2.5% to 13.89%, Improbable Capital only needs to boost them from 2.5% to 5.95%. The likelihood of this happening is now ~60.09%.

In our opinion, this also has two positive side-effects,

- It forces your team to think longer-term, and

- You're going to be more sure when you make decisions.

3. Reduce the time it takes to analyze a company

"Buffett claims he can give an answer on a prospective acquisition in five minutes ..." - The University of Berkshire Hathaway, Page 65

Intuition: the longer you spend analyzing bad ideas (a false positive) the less time you have to analyze good ones (a true positive).

Statistics: if Improbable Capital find a way to save 2/3 days off of their process that would mean they could analyze an extra 14 companies a year! This means that instead of needing to boost their odds from 2.5% to 5.95%, Improbable Capital only needs to boost them from 2.5% to 5.71%. The likelihood of this happening is now ~69.16%.

Okay, I hear you, high-quality research take time. You can't watch 100 hours of earnings calls in 5 hours. You also can't read 10 years of annual reports in an afternoon. However, all processes have room for improvement.

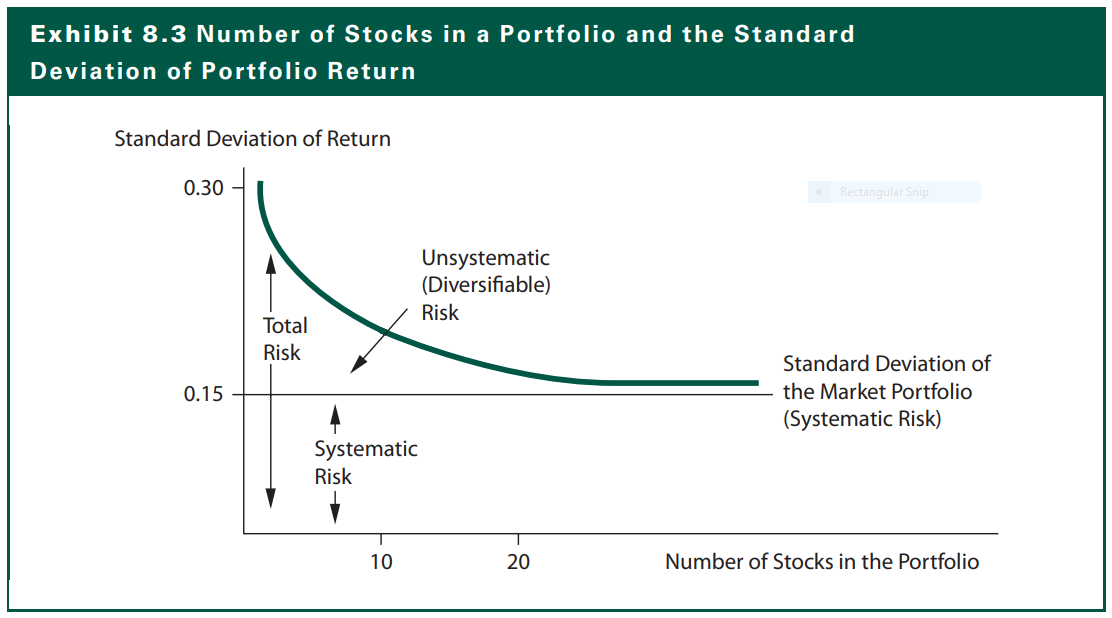

For example, one step in the research process that can easily take a couple days - particularly for smaller companies in unfamiliar geographies - is comparable company analysis. This involves identifying similar companies and doing a comparison to see how competitive they are. Are they growing more or less? Are they trading at a higher or lower multiple? Are they investing more or less into research and development? Are their profit margins higher or lower? This is something we have solved for our users at Nosible. What used to take days now only takes a couple of minutes.

4. Remain patient and be ready for a sale

"Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble." - Warren Buffett

Intuition: it's easier to find good ideas when everything is a good idea.

Statistics: let's assume there is a small drawdown in the market and the percentage of good ideas rises from 2.5% to 3.5%. Naturally boosting your odds from 3.5% to 5.71% is easier than going from 2.5% to 5.71%. This increases the likelihood from ~69.16% to ~90.02%.

5. Identify high-information filters

"Use filters so you don't waste time on unproductive ideas" - The University of Berkshire Hathaway, Page 243

Intuition: the better your ideas, the better your portfolio.

Statistics: high-information filters are ones that increase your TPR and reduce your FPR. For example, if Improbable Capital found a unique combination of factors that achieved a TPR of 85% and an FPR of 15% then the likelihood of them producing enough good ideas for their portfolio in a normal market (2.5%) would be virtually guaranteed ~100%.

An example of a low-information filter would be a metric or a screen that produces "value traps" a.k.a. cheap companies that are cheap for good reasons. To make matters worse, bad filters can even reduce your odds and make idea generation much harder than it needs to be.

High information filters is where Nosible shines. We have applied principles of information retrieval and artificial intelligence that power the world's best search engines to the problem of idea generation. In essence Nosible is a global equity recommendation system that learns personalized high-information filters that work for your investment team. We'll blog a bit more about how that works in the months to come. If you think you might find that interesting I invite you to subscribe to this blog for updates.

Concluding Remarks

A great idea generation process makes the job of an investment team so much easier. It also appears to me that investors, like Warren Buffett and Charlie Munger, who advocate for contrarian things probably do so because they have a far deeper understanding of the statistics that affect long-term investment success than academics who live in ivory towers 😉.

Thank you for reading, I hope you have enjoyed this post.

Stuart Reid

CEO & Founder, Nosible

** This estimate makes the following simplifying assumptions:

- TPR's less than 50% are impossible,

- TPR's between 50% to 100%are equally likely,

- FPR's greater than 50% are impossible, and

- FPR's between 0% and 50% are equally likely.

I think that (1) and (3) are reasonable assumptions because a TPR less than 50% or a FPR greater than 50% would be worse than random.

I think that (2) and (4) and generous because high TPR's and low FPR's would actually be less likely than middling ones. As such, the actual likelihoods are almost certainly lower, however, the effect of the interventions we showed would be the same so it doesn't actually matter.